by Jeremy Bryan, CFA

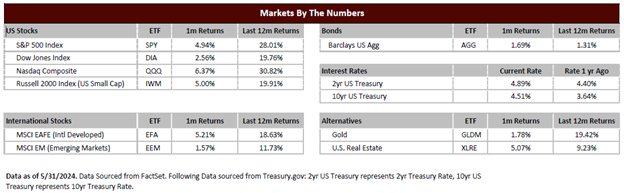

Stocks rallied in May and ended the month near all-time highs for the S&P 500. The index has been buoyed by technology, communications, and consumer companies that are large and have a significant influence on overall performance.

On the economic front, recent data has largely been within the range of expectations on inflation, jobs, and GDP. Actions of the US Federal Reserve (Fed), based on the trends of economic data, continue to be front of mind for investors. The current data paints the picture of a largely resilient economy but also one with lingering inflation that is stickier than most predicted.

Because of this resilient economy, the Fed has not transitioned to rate cuts that were expected early in the year. This has been a headwind for bonds and the main reason bond performance has been negative year to date. Despite the year-to-date performance, we believe bonds are still relatively opportunistic. Bonds have had higher than average volatility but are still less risky than the stock market. With higher rates, current yields provide greater income compared to just two or three years ago. We also believe rates are closer to a high point rather than a low point, and our opinion is the Fed’s next move is more likely to be an interest rate cut (even if later than expected). If this is correct, then bonds could provide good current yield and may provide better second half price performance if interest rates were to fall.

With regard to stocks, the level of concentration in the top ten stocks in the S&P 500 has actually increased in 2024. These top ten stocks now account for over 30% of the size of the index. While we do not believe this is any harbinger of doom, stocks like Microsoft (MSFT), Amazon (AMZN), Apple (AAPL), Alphabet (GOOG), and Nvidia (NVDA) have a large influence on overall market trends – both up and down. If these stocks were to falter, it would take a much broader rally from the other stocks to offset the performance decline of the top ten.

As always, our analysis of markets is based on business fundamentals. Those fundamentals are the health of the economy, the health and growth of companies within the economy, and the valuations of those businesses (or what we pay for those companies). When viewed under this lens, conditions are still on relatively stable ground. Economic trends are resilient and inflation is sticky but still headed in the right direction. Earnings continue to be relatively strong and company outlooks and commentary do not suggest imminent collapse. Valuation is the weakest factor as the S&P 500 is more expensive now compared to long-term averages. Valuation, however, is not a great indicator of near-term trends but does suggest more muted performance over the medium term.

As a result, we remain relatively optimistic but understand that it is often the things we do not see coming that have the biggest negative influence on performance. That is why we advocate for a prudent approach to investing that includes assets to protect from decline as well as growth assets that participate in long term positive trends. The balance and weight of these assets should be based on a custom-tailored investment plan that establishes goals while simultaneously managing for risk and time horizon.

*This endorsement of Gradient Investments, LLC is provided by an investment advisor who refers clients to Gradient Investments, LLC. A conflict of interest exists because this investment advisor receives a portion of the annual management fee charged by Gradient Investments, LLC, based on the assets under management of this investment advisor’s clients. This endorsement could assist in the investment advisor increasing the assets placed with Gradient Investments, LLC, and therefore their compensation. These investment advisors are not affiliated with or supervised by Gradient Investments, LLC.